When we launched our healthcare price transparency offerings in 2021, the only pricing data available was from hospitals, as they were the only group CMS required to publish prices at that time.

Since July 1, 2022, however, payers (that is, insurance companies) have also been required to make pricing data available to the public.

We’re thrilled to announce that we’ve been busy incorporating this data into our system, meaning our customers can now get much more detailed, granular, and up-to-date pricing data for the regions, services, facilities, or payers they care about.

Let’s take a look at why this is such a big deal and how HDA customers will benefit.

Published Payer Pricing Data Is Hugely Valuable – But Mostly Inaccessible without an Intermediary

First, we want to emphasize two things: the data healthcare payers have published has the potential to be incredibly valuable to hospitals, health plans, consultants, tech companies, revenue cycle companies, large employers, and more.

That’s partly because the reporting requirements for payers are different from those for hospitals:

- Payers must report prices for every entity they contract with: hospitals, ambulatory surgery centers, large employers, etc., meaning they must report more data than hospitals are required to.

- Payers must update data monthly (vs. only annually for hospitals).

- Payer reporting is enforced at the state level (vs. at the federal level for hospitals).

- Fines for noncompliant payers can be much higher than those for hospitals because they can be assessed per member. Large payer groups with millions of members, then, could face substantial fines for noncompliance.

In part because of these large potential fines and in part because payers tend to have large data teams already in place, payers have complied more quickly and more thoroughly with CMS data publication requirements than hospitals did.

But there’s a catch – and that’s the second thing we want to emphasize: because payers are publishing so much data and updating it so frequently, the files they’re making “publicly available” are often too big for people to download with a personal computer. For context: a typical pricing file is between three and five GB zipped (though we’ve encountered files up to 130 GB zipped). When the files are unzipped, they increase in size substantially.

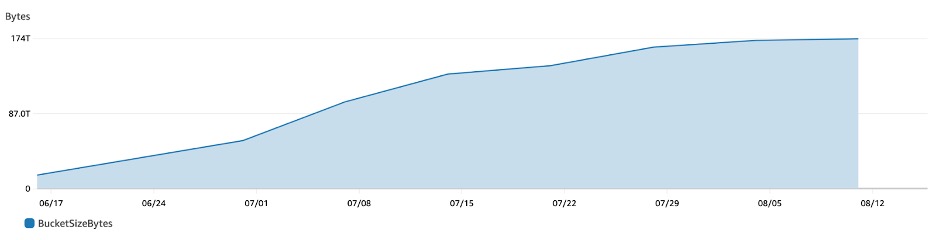

As of mid-August, HDA’s system includes about 174 TB (terabytes) of data (see Figure 1) from payers such as Elevance (formerly Anthem), Aetna, UHC, BCBS, Cigna, and others. To put that in perspective, the greatest amount of storage most personal computers offer is 2TB – which would be enough to store 200,000 photos.

Beyond the sheer quantity of data out there, the data itself also presents other challenges. For one thing, we’ve discovered that these files include a fair amount of duplicate data. For another, there are some mistakes, notably missing information and inaccuracies (we typically spot these in the form of outliers).

Part of the work we do is to clean and normalize the data we gather so that when we make it available to customers, it’s accurate, reliable, and usable.

The big takeaway for people who need access to this data to guide business decisions is that third-party data aggregators (like us!) are essential to turning all that raw data into useful business intelligence. Now let’s take a look at how payer pricing data can help you.

How Payer Price Data Benefits HDA Customers

One of the original intents of CMS price transparency rules was to increase competition in the US healthcare system. The operating premise was that more data transparency would lead to more competition.

Indeed, now that payers are reporting prices (for hospitals, outpatient care centers, large employers, etc.), we’re getting much closer to a reality where any party can easily observe the range of prices for a given service and advocate for the price they think is fairest.

Let’s take a look at how that might benefit various groups that might use this data.

Hospitals

We’ve written in the past about the various use cases hospitals and hospital groups might have for price transparency data: being able to set prices more confidently, setting prices on emerging services, tracking trends year over year, and fueling negotiations with payers. This isn’t just hypothetical: a hospital customer recently asked for data and used it in payer negotiations to secure fairer prices for its services.

The introduction of payer data means that hospitals can now get even more visibility into current prices, meaning they can even more confidently and effectively make decisions about pricing and negotiate with partners.

Payers

Of course, negotiations go both ways. Payers, too, can use data during negotiations with hospitals to power more productive conversations that lead to outcomes that work better for everyone.

Another service payers may be interested in is our compliance reports. As we’ve processed hundreds of terabytes of payer data, we’ve noticed some of the most common mistakes that can lead to unnecessary costs (e.g., a decimal point in the wrong place that grossly inflates or shrinks a payer’s stated reimbursement for a service). We’ve also identified the common mistakes that cause well-intentioned payers to become non-compliant (like missing data).

We’re happy to offer relevant insight to payers who would find it valuable. (Get in touch if you’re interested in an assessment of your compliance!)

Revenue Cycle Consultants

Revenue cycle consultants may be able to use our data to uncover opportunities to pass on to hospital clients. This may be particularly valuable for consultants working with hospitals that have limited in-house data staff.

App Developers

From the earliest days of the price transparency rules, CMS and other leaders hoped that app developers and others in the tech space would find ways to use pricing data to create customer- or employer-facing tools that can help people make more cost-effective healthcare decisions.

With payer data now readily available, our database is better positioned than ever to fuel such applications and create more cost-effective ways of navigating healthcare for a variety of parties.

Get Increased Price Granularity from HDA’s Payer Data

One reason we’re so excited about being able to offer payer pricing data is that the sheer volume of this data means we can satisfy more customized use cases with more accuracy than ever.

For example, we know that not all billing codes will be interesting to all of our customers. So we’ve created “baskets” that bundle related codes for ease of use:

- Cardiac

- Pediatrics

- Obstetrics

- Surgery

- Orthopedics

- Oncology

- Radiology

- Palliative Care

- Emergency Department/Emergency Services

- Rehabilitation

- Behavioral Health

- Circulatory

- Maternity

- Musculoskeletal

An outpatient oncology clinic, for example, might be interested in our oncology basket for three nearby cities – and we now have the data to provide pricing information to fulfill that need.

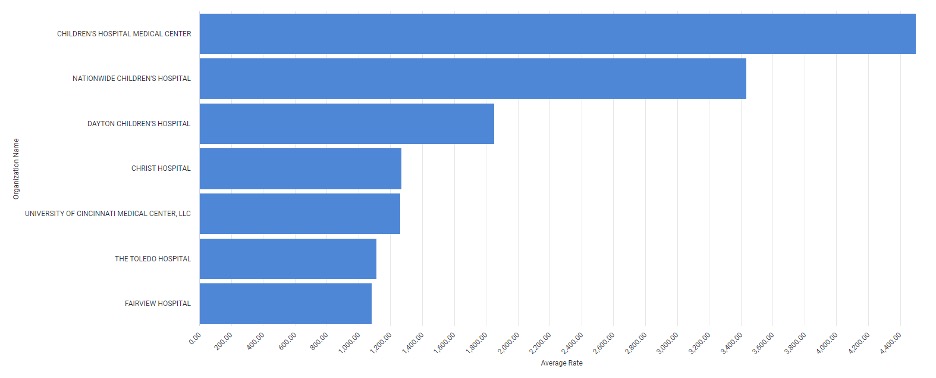

Or a children’s hospital may want to see prices in nearby cities and nearby hospitals for a single billing code – say, CPT® 69930, Under Introduction Procedures on the Inner Ear. We can easily pull that up (see Figure 2). Of course, a customer requesting that information would get a detailed breakdown as well.

Broadly speaking, we now have the data to meet a greater variety of needs. Please reach out if you’re curious about whether we might be able to meet yours!

A World of Possibility Is Waiting in Our Data

While our customers have always found value in our price transparency data, the introduction of payer data marks a new era of opportunity for a broader range of users and use cases. If you’ve been considering ways healthcare pricing data might improve your daily operations, now is the time to start a conversation.

We love customizing data sets and visualizations to help our customers find the insights that propel them forward – and we’d love to hear how we can help you!